Story medicare enrollment process: your path to coverage

The Medicare enrollment process involves checking eligibility, understanding coverage options, knowing important enrollment timelines, avoiding common mistakes, and preparing necessary documentation for a successful application.

The story medicare enrollment process can seem overwhelming at first. Understanding the steps involved can make the journey easier and ensure you secure the coverage you need. Let’s dive into how to navigate this important process.

What is the medicare enrollment process?

The medicare enrollment process can be confusing, especially for first-time applicants. Understanding the key steps can ensure that you secure your healthcare benefits without a hitch. In this section, we’ll break down what the enrollment process involves.

Understanding Medicare Enrollment

Medicare is designed for those who need healthcare coverage, especially individuals aged 65 and older. However, knowing when and how to enroll is crucial. The process typically begins with determining your eligibility based on age or disability status.

Key Steps in the Enrollment Process

Here are the main steps to follow:

- Check your eligibility: Make sure you meet the criteria for Medicare.

- Gather necessary documents: You will need personal identification, such as your Social Security Number.

- Choose your coverage options: Understand the different parts of Medicare, including A, B, C, and D.

- Complete the enrollment form: You can apply online, by phone, or in person.

Once you’ve gathered the required information, it’s essential to be aware of the enrollment periods. Each year, there are specific times when you can sign up for or change your Medicare plan. Missing these deadlines could delay your coverage or result in penalties.

Final Notes on Enrollment

It’s important not to rush through the medicare enrollment process. Taking your time to make informed decisions will help you find the best fit for your healthcare needs. Next, we will explore eligibility requirements to ensure you qualify for the coverage.

Key eligibility requirements for medicare

The key eligibility requirements for Medicare are important to understand for anyone approaching retirement age or dealing with certain health conditions. Ensuring you meet these criteria can help you gain essential healthcare coverage.

Who Qualifies for Medicare?

Generally, you are eligible for Medicare if you are 65 years or older, have been receiving Social Security benefits for a certain period, or have a qualifying disability. Additionally, there are specific requirements for individuals with certain medical conditions, such as end-stage renal disease or amyotrophic lateral sclerosis (ALS).

Requirements Overview

Here are the main requirements to keep in mind:

- Age: You must be 65 years old or older.

- Citizenship: You must be a U.S. citizen or a permanent resident.

- Work History: You should have paid Medicare taxes for at least 10 years or be eligible through your spouse.

- Disability: You may qualify before age 65 if you have a qualifying disability.

It’s crucial to note that even if you meet these requirements, certain enrollment periods apply. Keep an eye on the Initial Enrollment Period (IEP) when you turn 65, as well as General and Special Enrollment Periods if you missed the initial window.

Understanding Special Cases

Some individuals may fall into special situations qualifying them for Medicare. For instance, if you have a long-term disability, the 24-month waiting period for Medicare coverage may not be necessary in some cases. Understanding your unique situation is key to accessing Medicare effectively.

By thoroughly reviewing the key eligibility requirements for Medicare, you can ensure you are prepared and informed about when and how to enroll. Next, we will discuss the important timelines for enrollment that you need to keep track of.

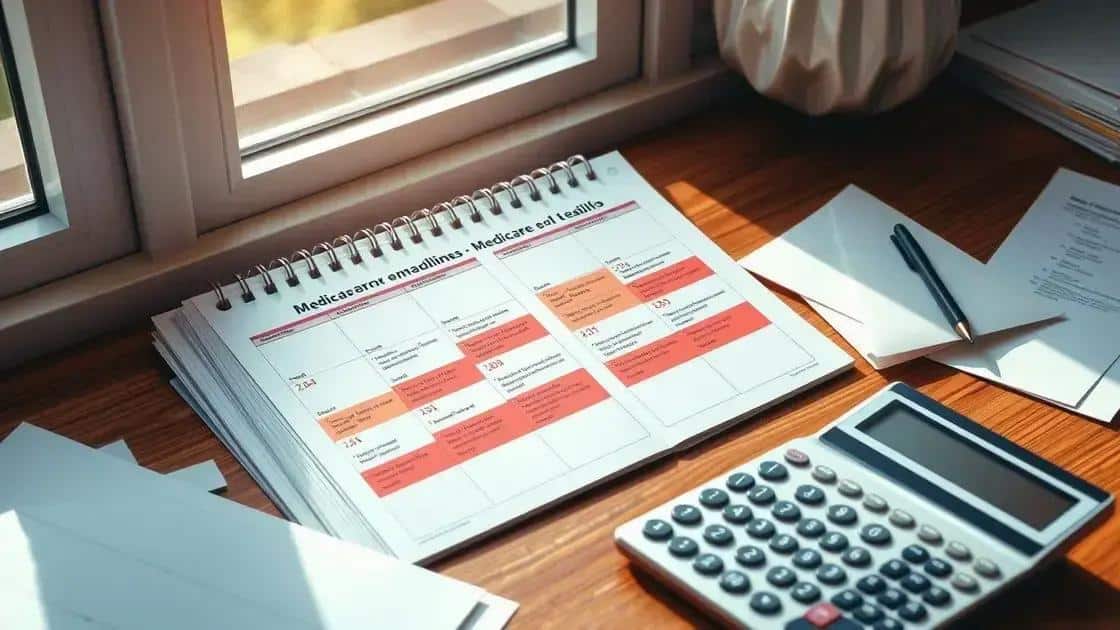

Important timelines for enrollment

Understanding the important timelines for enrollment in Medicare is crucial to ensuring that you do not miss out on your healthcare coverage. Timely action can make a significant difference in the benefits you receive.

Initial Enrollment Period

Your Initial Enrollment Period (IEP) is a seven-month window that starts three months before you turn 65, includes your birthday month, and ends three months afterward. This is the best time to enroll in Medicare without facing any penalties.

General Enrollment Period

If you miss your IEP, you can still enroll during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. Keep in mind that coverage will not begin until July 1, so it’s best to enroll during your IEP if possible.

Special Enrollment Periods

There are Special Enrollment Periods (SEPs) available for individuals who experience certain life events. These can include moving, losing other health coverage, or other qualifying changes. SEPs can vary in length, so be sure to act quickly if you qualify.

Annual Open Enrollment

The Annual Enrollment Period (AEP), from October 15 to December 7, allows you to make changes to your Medicare plans. During this time, you can switch between plans, add coverage, or change your prescription drug plan. This is also a good opportunity to reassess your healthcare needs.

By keeping track of these important timelines for enrollment, you can ensure that you are prepared and eligible for the healthcare coverage that meets your needs. Timing is everything, so mark your calendar!

Common mistakes to avoid during enrollment

During the medicare enrollment process, many people make mistakes that can lead to delays or penalties. It’s essential to be aware of these issues to ensure a smooth application experience.

Failing to Understand Enrollment Periods

One common mistake is not fully understanding the different enrollment periods. Many individuals miss the Initial Enrollment Period because they don’t realize it lasts only seven months. Always mark your calendar and stay aware of these critical dates.

Not Reviewing Coverage Options

Choosing the wrong plan can also be a significant error. Medicare has different parts, including A, B, C, and D, each covering various aspects of healthcare. It’s vital to review each option closely to select the coverage that best fits your needs.

Ignoring Late Enrollment Penalties

Another mistake is overlooking potential late enrollment penalties. If you delay enrolling without qualifying for a Special Enrollment Period, you could face higher premiums. Understanding the implications of your enrollment timeline is critical.

Missing Documentation

Being unprepared with necessary documentation can also set you back. Before applying, gather essential documents like your Social Security Number, proof of citizenship, and any other identification required. This makes the process smoother and faster.

By remaining vigilant about these common mistakes to avoid during enrollment, you can enhance your experience and secure the benefits you need. Planning ahead and being informed will help you navigate the medicare enrollment process successfully.

Tips for a successful medicare application

Having the right strategies can make a big difference in ensuring a successful medicare application. With the right preparations, you can navigate the process more smoothly and avoid unnecessary setbacks.

Gather Necessary Documents

Before starting your application, make sure you have all required documents on hand. Key documents often include your Social Security Number, proof of your U.S. citizenship or legal residency, and information concerning your job history. Having these ready will speed up the process.

Understand Your Coverage Options

It’s crucial to closely review your coverage options. Familiarize yourself with the different parts of Medicare: Part A covers hospital insurance, Part B covers medical insurance, and you may also consider Part C (Medicare Advantage) and Part D (prescription drug coverage). Knowing what each part covers will help you make an informed choice.

Keep Track of Important Dates

Mark your calendar with important enrollment dates. Missing your Initial Enrollment Period could result in penalties or a delay in coverage. Manage your application timeline closely to ensure you don’t miss out on essential deadlines.

Ask for Help If Needed

If you find yourself confused at any point in the process, don’t hesitate to ask for help. There are resources available, such as Medicare counselors, who can guide you through any challenges you may encounter. This can make a considerable difference in easing the application process.

By following these tips for a successful medicare application, you can enhance your chances of securing the health coverage you need. Proper planning and understanding of the process are key elements to ensure smooth sailing.

In conclusion, navigating the Medicare enrollment process doesn’t have to be overwhelming. By understanding the key eligibility requirements, important timelines, and common mistakes to avoid, you can ensure a smoother application experience. Remember to gather necessary documents and stay informed about your coverage options. With the right preparation and knowledge, you can secure the healthcare benefits that you deserve. Don’t hesitate to reach out for help when you need it. Taking the first step is crucial for your health and well-being.

FAQ – Frequently Asked Questions about Medicare Enrollment

What is the Initial Enrollment Period for Medicare?

The Initial Enrollment Period is a seven-month window starting three months before you turn 65, including your birthday month.

How can I avoid late enrollment penalties?

To avoid penalties, make sure you enroll during your Initial Enrollment Period unless you qualify for a Special Enrollment Period.

What documents do I need for my Medicare application?

You will need your Social Security Number, proof of U.S. citizenship or legal residency, and job history information.

Are there any resources available to help with the enrollment process?

Yes, you can consult Medicare counselors or visit the official Medicare website for assistance with your application.